By: Molly Holbert, Marketing & Investment Coordinator, MACC Venture Partners

By: Molly Holbert, Marketing & Investment Coordinator, MACC Venture Partners

Why High-Net-Worth Investors Seek increased Real Estate Allocations

The commercial real estate landscape is continuing to become more easily accessible to investors due to the fusion of technology in the industry. Today, an accredited investor can directly invest in a sponsor's multifamily asset, purely online, without needing a licensed investment broker or even speaking to the sponsor. Investor Management Services (IMS) is a software firm that allows sponsors to offer investors access to an investor dashboard where they can go through a quick self-accrediting process, invest in properties, and stay up to date with their returns and tax documents. IMS also provides efficiency for the sponsor to track complex financial transactions that occur throughout the period of operating a property and providing distributions to investors. IMS increases investment transparency, improving the investment experience for individual investors because of easily accessible data on each of their investments.

Easier access to real estate investing has also increased competition. According to Robert Brunswick in a recent National Real Estate Investor article, there is potential for a pricing bubble in real estate investing. These concerns have been raised from a flood of capital into high-end commercial real estate from sovereign wealth funds, domestic pension funds, and life insurance companies. This flood has resulted in a “return-starved” market, leaving Ultra-high-net-worth (HNW) and family office portfolios to seek less saturated investment options.

Brunswick noted, “real estate still functions predominately within a private marketplace, and with certain inefficiencies that, when properly priced and sourced, can provide returns in excess of comparable benchmark indexes.” Its hard to beat higher returns than benchmark indices and there are several other benefits of investing in real estate, specifically apartments. Among those reasons to invest in apartments is steady cash flow and a diversified tenant base. Brunswick also mentioned “Larger investment firms typically put capital to work in gateway cities and in larger investment amounts, providing opportunity within the middle market for transactions in the $20 million to $75 million range, and in non-gateway cities.”

Flip That... Apartment!

When high-net-worth investors are able to find successful middle market sponsors, they can receive passive income without the hassle of a mortgage and other time consuming responsibilities real estate entrepreneurship requires. The passive income is distributed to investors after the local sponsor uses their expertise to conduct thorough market research, underwriting, and deal sourcing to acquire the right value-add opportunity. It is a much larger scale version of the popular HGTV show, Flip or Flop, that has motivated an abundance of entrepreneurs to enter the real estate game.

Finding the right deal is an extensive process, especially when it comes to apartments; they also are not a quick money maker like a successful single-family flip has a reputation to be. Furthermore, there is income from multiple renters. Unlike a flipper who must pour cash into a house to sell it, there is also opportunity for cash flow as a multifamily operator collects rent income from occupied units. In addition to cash flow during an apartment "flip," investors can also take advantage of a local sponsor's established operations; which lowers costs and ultimately leaves more capital to distribute to investors.

Secondary Markets are Gateways for Domestic Migration

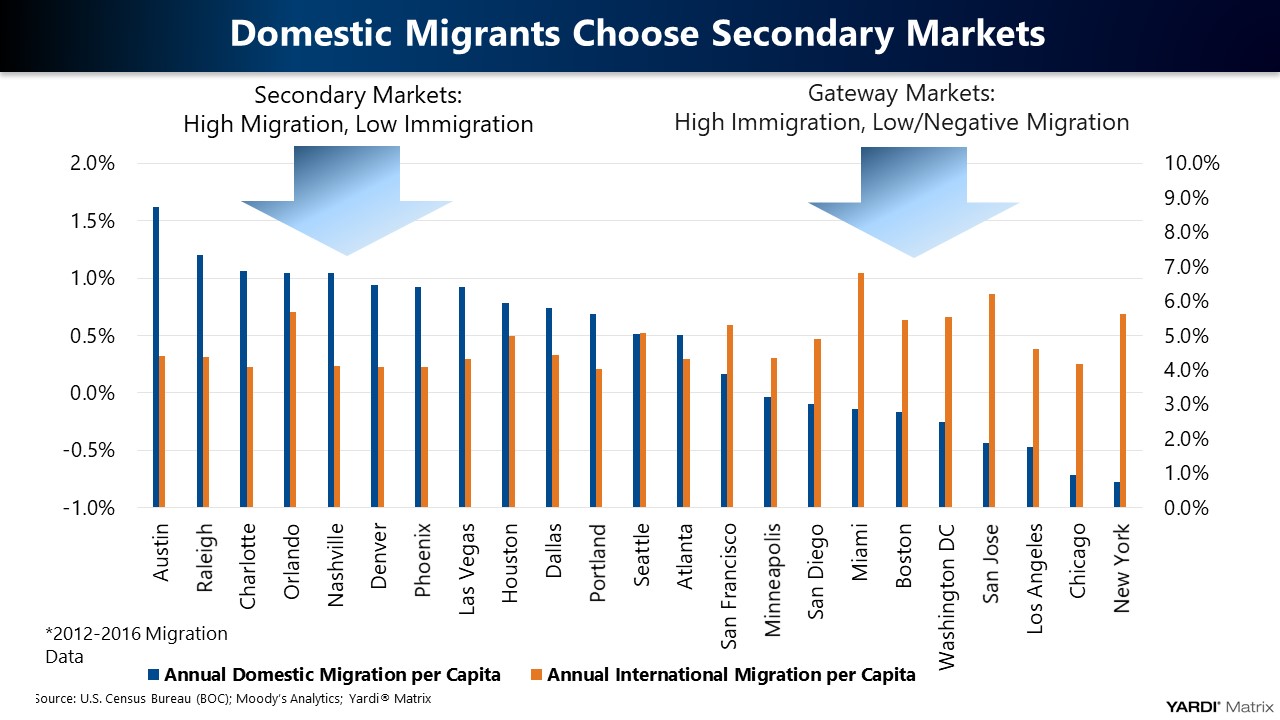

This graph from the Yardi Systems US Multifamily Strategy & 2017 update, shows a significant increase of migration in non-gateway markets from 2012 to 2016. Negative migration in gateway markets can be linked to Americans seeking affordable living, resulting in high demand for middle market apartment communities. Though gateway cities, such as New York, Chicago and Boston, are constantly making headlines for promising real estate investment locations, non-gateway cities offer significant returns and less competition from high-end commercial investors. Brunswick said, “Interestingly, these non-gateway cities display many positive demographic trends, including continued job growth that enhances property rent rolls and income performance.” Cities such as Greenville, SC, Columbia, SC, Greensboro/Winston-Salem, NC and countless more, offer lower acquisition prices for the middle market sponsors to afford; enabling high-net-worth investors to tap into the real estate investing market.

This graph from the Yardi Systems US Multifamily Strategy & 2017 update, shows a significant increase of migration in non-gateway markets from 2012 to 2016. Negative migration in gateway markets can be linked to Americans seeking affordable living, resulting in high demand for middle market apartment communities. Though gateway cities, such as New York, Chicago and Boston, are constantly making headlines for promising real estate investment locations, non-gateway cities offer significant returns and less competition from high-end commercial investors. Brunswick said, “Interestingly, these non-gateway cities display many positive demographic trends, including continued job growth that enhances property rent rolls and income performance.” Cities such as Greenville, SC, Columbia, SC, Greensboro/Winston-Salem, NC and countless more, offer lower acquisition prices for the middle market sponsors to afford; enabling high-net-worth investors to tap into the real estate investing market.

Are you an accredited investor looking for high returns and a local operator to trust with your investment? Make a free investor account by clicking the image below:

Photo from SA Homes, article references from NREI, and graph from Yardi Matrix