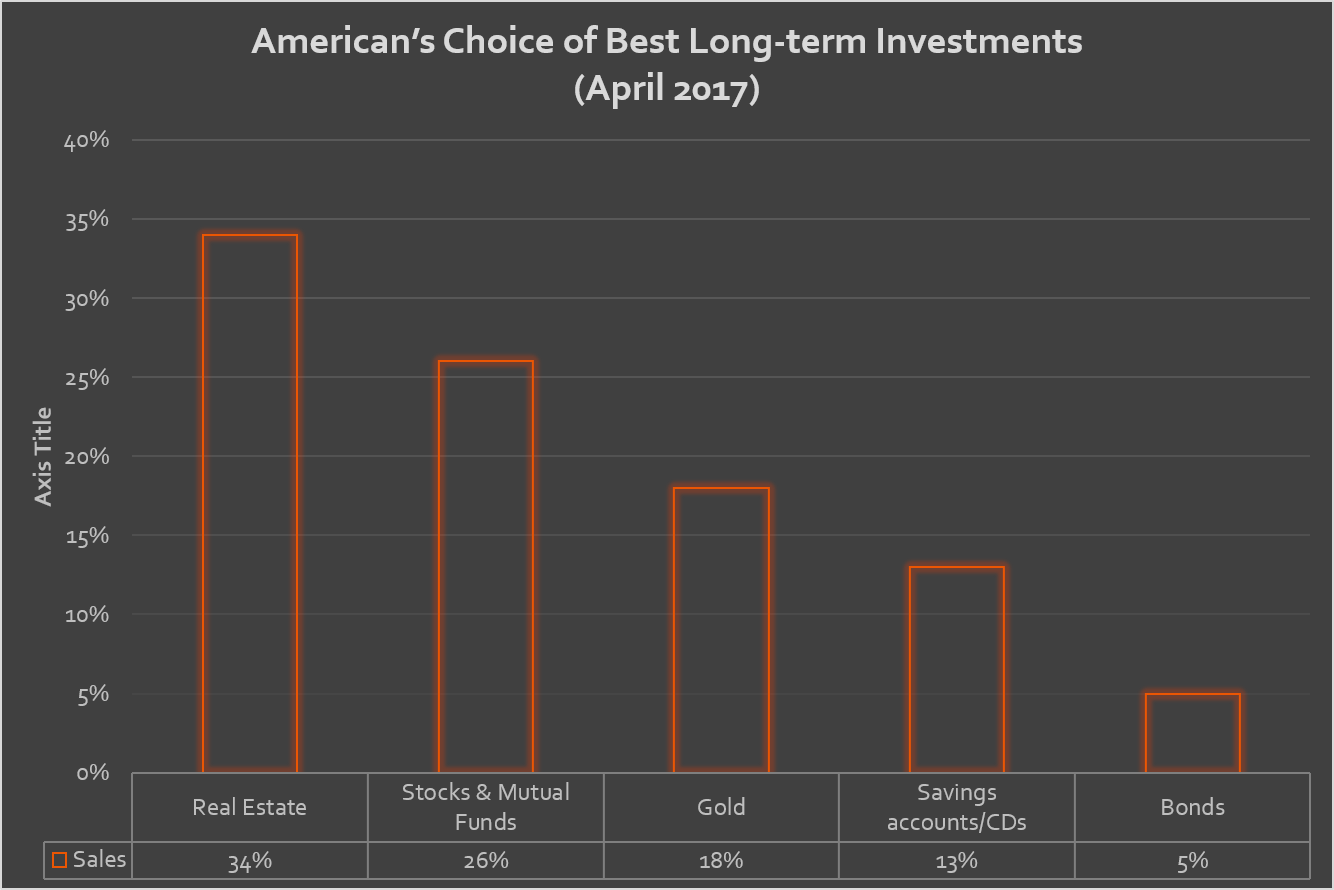

If you find yourself watching CNBC or reading the Wall Street Journal in the morning, you would have noticed the erratic movements of the stock and bond markets. You have undoubtedly noticed the precipitous losses that slammed the DOW, NASDAQ, and S&P 500 this week as the world grapples with the deleterious effects of Corona Virus on economic engines. We have managed to stay calm and focused knowing that we are in a business that not only can withstand erratic shifts in world markets but sometimes even benefit from them. The commercial real estate industry and more specifically Multifamily investments have been and will continue to be an amazing safety haven for investors. But they are not merely safety havens, they are also a substantial profit and cashflow vehicle and possibly one of the best tax remediation strategies investors can have as part of their balanced portfolio.

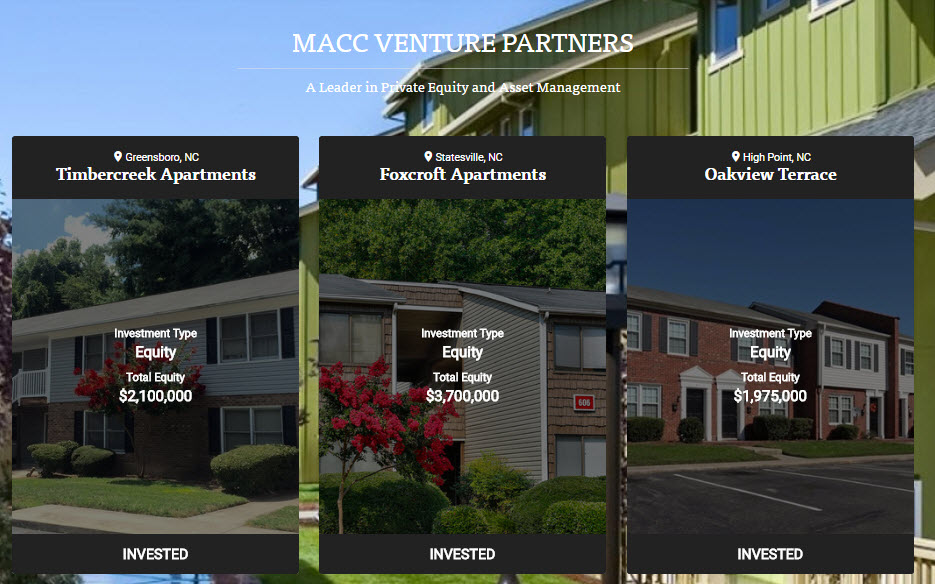

Today, our investments in the Southeast region and our portfolio as a whole have continued to reward us and our investors with steady returns and tax advantaged distributions, despite the volatility of the stock market; nor do we have a drop in our assets value. Our initial problem with the stock market was that we have no direct control in how our investment performs. Multifamily investment is different. Having the ability to hop on a call with our management team or drive to our properties allow us to keep constant contact with our properties and their performance. Now, let’s talk about a few reasons why real estate investing, and more specifically Multifamily investments are better and in the longer term more profitable than traditional stock investing

Physical Investment:

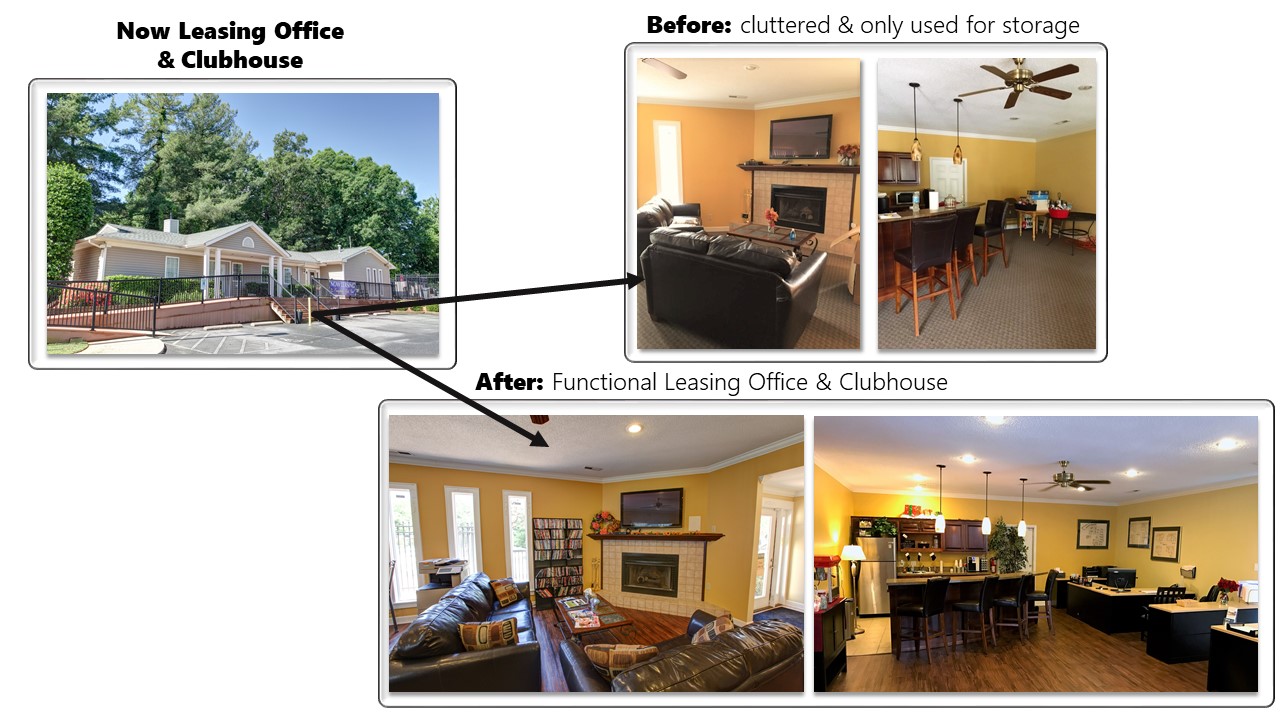

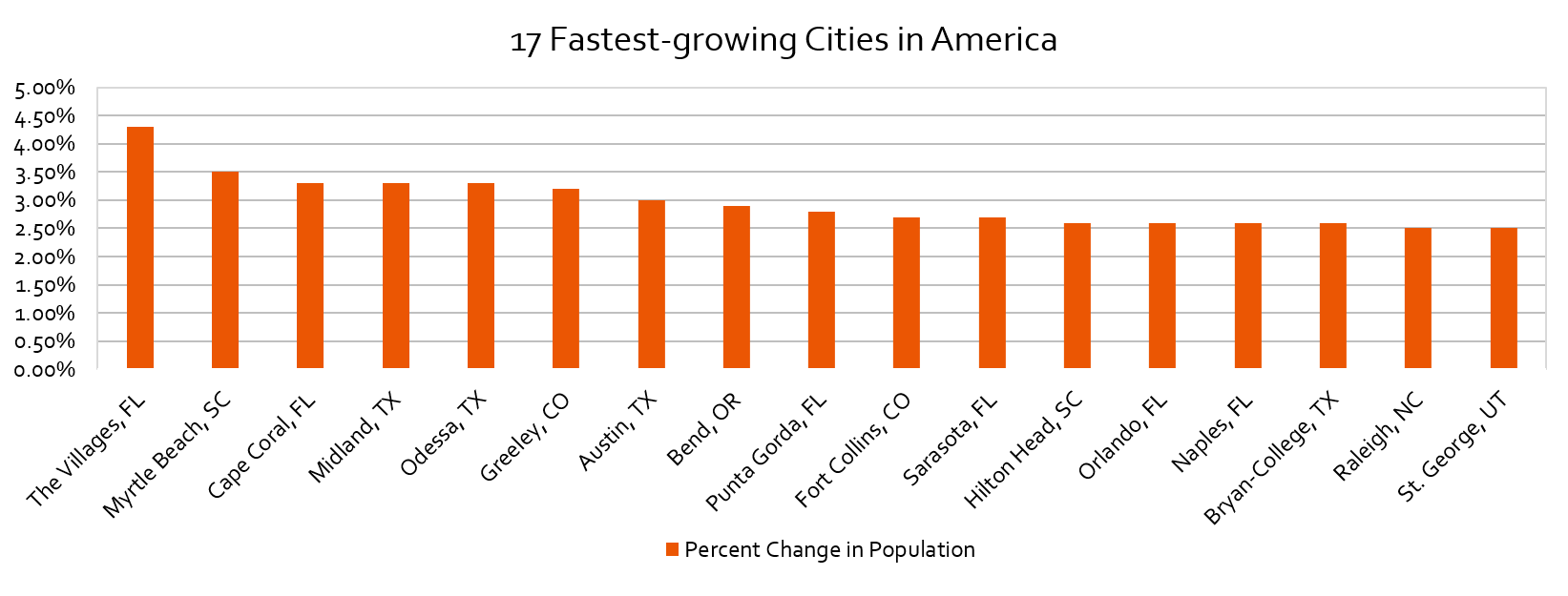

The first obvious benefit of real estate vs. stocks is that you’re investing in a physical piece of land or building. This is great because there is only so much land on this planet! The supply of tangible land on earth is not going to increase and because of this having a physical investment allows the investor to keep a close eye on the investment which allows for the owner to make necessary improvements if needed. This is something you cannot do with stocks.

Taxes:

The second reason real estate investing is superior to stocks is due to the tax benefits associated with RE. Real estate allows investors to save large amounts of money from Uncle Sam. Investing in stocks will allow you to save a small amount in taxes if you hold your stocks for over a year, which would allow your investment to be taxed at the slightly lower capital gains tax rate instead of your ordinary tax rate. This can amount to slight increase in tax savings but not nearly anything tangible in comparison to the savings you will attain through real estate; which presents numerous ways to decrease taxes that far outperform stocks. The first way is by the use of depreciation to offset income for an income-producing real estate asset. The longer something exists the more it deteriorates. An additional way to save a considerable amount of taxes from your investment income (as well as your ordinary income if you’re still working a day job) is by engaging with a tax professional that will help by conducting a cost segregation study. This study essentially details every part of an investment property and gives a depreciation timetable for each integral part. This will allow you to speed up the depreciation process and save more. It is important to remember that when it comes to your return on a real estate asset or a stock, it’s not the amount of money that’s produced but rather how much money you take home after paying taxes.

Due Diligence:

As always, an investor should engage in an intensive due diligence period for real estate investments as well as stocks; however, most investors tend to do more due diligence for real estate investments than stock investments. This tends to happen for a number of reasons. To start with, real estate is more illiquid, which people tend to look at as a bad thing, but it is quite the opposite. The ready liquidity of certain investments like stocks or bonds can sometimes make investors act too impulsively as a reaction to a market anomaly that may or may not have any effect on their investments in the long term. This ends up costing investors losses because it is very hard to time markets correctly. With real estate, the investment is illiquid by nature and cannot be sold as quickly as stocks, so the impulsiveness of stock investing is not there. Plus, the time value of appreciation in real estate tend to always work to ones favor with more passing of time (see the paragraph about physical investment). In multifamily, time is needed to season the asset and implement both cost saving measures as well as tax savings. Hence illiquidity is a friend in real estate. Also related to due diligence is the fact that investors tend to dive into the financials, rental contracts, and overall condition of a property for good reasons. A real estate investment is an investment in a physical asset. Investors tend to have more of a connection with something physical which in turn means they will do more homework on said investment. However, we recommend that the homework doesn’t cease there. We always encourage our investors to do their homework on us as well as other principle sponsors or operators who would be, in essence, managing their investments. A seasoned operator with the right staff, market knowledge, performance history and a proper team in place is just as important as the investment itself. Lastly, all of the paperwork and time necessary to acquire a real estate investment. All of the paperwork and time that is put into the property means the prospective investor will ultimately know more about their potential investment. When it comes to stocks, all you need is an account set up with a brokerage firm and you can buy and sell shares almost instantly.